Beware of what you wish for. So what will happen if Congress & co. ultimately gets its wish? There are two immediate consequences, neither of which are subtle in their effects:

First, the price of every Chinese import (think Wal Mart) will immediately and proportionately increase, manifesting as a round of high --though not yet hyper-- inflation. This will in turn serve to further reduce whatever is left of the U.S. consumers' discretionary budget, and thus push another unknown percentage of homeowners over the edge into further mortgage defaults and late credit card payments; items which, sad to say, U.S. Banksters are still allowed to point to as the initial cause for the on-going global crisis. After all, it's not their fault: they didn't see it coming.

The second consequence is, of course, that China itself will then obtain fewer dollars from trade --not only due to the numerical revaluation of its currency, but because consumers who buy in dollars will simply not be able to afford as many Chinese products. However, fewer dollars for the Chinese thus also directly reduces any commensurate need to buy U.S. Treasuries --even aside from the fact that they have already started withdrawing from that market, and may even be net sellers already. All this merely serves to exacerbate an already extent process of negative feedback: The less the demand for Treasuries, the lower the bidding price and the higher their yields become. The government is then forced to borrow money at a higher rate of interest, which increases the risk of buying Treasuries in the first place, which lowers the demand, which increases the interest. Where does this interest payment come from? Declining tax revenues! --which is, no doubt, the very reason why certain congressional members want China to revalue the yuan relative to the dollar: i.e. in order to increase the "competitiveness" of U.S. exports! Funny, no?

Want to hear something even funnier? The greater bulk of Chinese imports are really coming from U.S. corporations, who have merely outsourced their labor pools to increase their profit margins by selling to whomever is still employed. All of this is commonly known, but corporate self-interest is a sacred cow. Here is Congress, attempting to force Chinese monetary policy in order to protect ourselves from the depredations of American corporate culture. How ironic is that!? One might hope that our politicians could connect at least two of the most obvious dots, and thus begin to suspect that real solutions might just lie much closer to home than Beijing.

So why did Tim Geithner make a sudden trip to China yesterday? Many seem to presume that it was to offer some kind of olive branch, though in truth, no details of discussions have yet been released; however, the most logical inference we can make is that he was, and is now, highly motivated to plead with the Chinese not to revalue their currency, for the very reasons just discussed. Maybe the gods just love a good comedy in which the antagonist is quickly hoisted on his own petard; because if the Chinese ever do accede to official Congressional demands, it will primarily be only because it suits their own purposes. In any event, the U.S. economy --which is already coming apart at the seams-- will continue to unravel at an increasingly accelerated pace. Besides, the Chinese already have reasons of their own to begin a controlled rise in the relative value of the yuan, since it should be apparent to all that they are attempting to position the yuan to become the global alternative to the dollar as the reserve currency of choice.

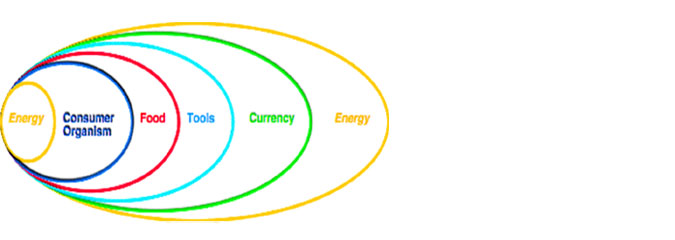

When all is said and done, the continual economic deterioration of the U.S. is now unavoidable, primarily because its guiding lights are trapped in illusory catch-22's of their own making. For the underlying physical economy of main street is entire comprised of physical energy sources and processes. One can of course, symbolically misrepresent this basic reality with all the paper one cares to print, but the paper economy --the fiat "monetary" system, which appears so wonderfully flexible to the crackpot economists of the present day-- is, in reality, rigidly tied to the underlying energy flow that comprises the physical economy, in precisely the same sense that the symbolic representations of mathematics cannot be arbitrarily divorced from the dynamics of any given physical process to which they are applied.

The alleged "recovery" is thus nothing more than an illusion generated by an official distortion of the true facts and figures. Like the financial industry itself, the economic structure of the country is already a brittle hollow shell, and currently sustained by nothing more than a highly sophisticated, but symbolically fraudulent system of arithmetical smoke and mirrors. Timmy G. is merely a mouse at the base of an avalanche of pending effects, scurrying about in pathetic desperation. But there is simply no real room left for maneuvering. The Treasury market is already showing signs of severe stress, and beneath the public radar, the forces of decline continue to accumulate. The world is gagging on the vast sums of government bonds being printed and offered up worldwide. You can therefore be absolutely certain that interest rates will continue to be forced upward by the underlying market, regardless of every effort by Government Sachs to prevent it.

The lesson in all this is really quite simple. Ignorance with respect to the underlying physical nature of economic systems is utterly incapable of formulating any appropriate response to states of economic decline. To the clueless clutch of congressmen, modern economists and financial 'geniuses' currently in charge, it thus seems entirely reasonable to expect that an economic crisis can thus be addressed with methods of accounting. These people are neither capable of independent thought nor of understanding the very events in which they are immersed in terms of physics. They haven't the slightest notion that their economic "theory" is simply a futile attempt to exempt themselves --with nothing more in hand than a symbolic currency system-- from the inescapable grasp of E= MC2. Thus, every action they now take will simply boomerang around to strike them on the back of the head with a force in direct proportion to the depth of decline. We may in fact, expect them to continue until they simply pound their faces (and us with them) into the ground. Not, of course, that the little bottom-feeders would ever notice.