"Energy is also measured in joules. In many ways it resembles money: it is a currency in which all processes in nature must be paid for. Just as money can come in dollars, pesos, yen, rubles or liras, so energy can come in many forms--electricity, heat, light, sound, [kinetic], [mechanical], chemical, nuclear."

Mankind as a whole is profoundly muddled concerning the nature of economics. The most prominent symptom of this is represented by the common euphemistic assertion that economics is an extremely ‘complex’ phenomena, first of all because it appears ‘inarguably’ comprised of a vast host of distinctly different physical “factors,” but whose ultimate impact is also determined by the vagaries of human psychology.

This would be laughable if it did not also reflect an essentially universal consensus. There is scarcely a soul on the planet that does not accept this state of affairs as an inevitable fact of nature. So instead of laughing, I –who may be the ultimate contrarian— am forced to feeling far more appalled and saddened than entertained by mankind’s general incapacity for critical thinking.

Even our scientists don’t question the most basic premises of modern economics. Why? Apparently, the reason is because it’s not a field of science –an observation that of course, merely points to the reason behind the reason: that they are themselves generally incapable of recognizing their own immersion in a cultural cul-de-sac of circular reasoning.

Here is what I mean. I have yet to meet anyone who doesn’t automatically accept it as a fact that economics is something that originated with barter and trade. The moment once accepts this premise as a fundamental principle of economics however, is precisely the very same moment in which one stumbles blindly into a labyrinth of unintegrated ideas and circular logic, because the act of trade presupposes a far more fundamental and energetic set of principles.

For the sake of what brevity is possible at this point, I will state the reality more succinctly. Life is subject to the phenomenon of economics for the simple reason that it gets hungry. This is why food is ultimately the most basic of economic necessities, but even this is merely a foreground expression for the reality –entirely provable—that “economics” is grounded in pure physics, because life itself is nothing more or less than the biological manifestation of a circular, feedback energy process.

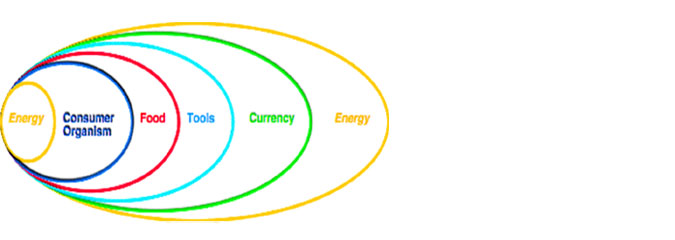

Make no mistake. There are no other principles, and the only reason you believe otherwise is because you have been deeply immersed in the concepts and trade language of money since you were in diapers. But “economics” is pure physics, and I can say this without equivocation, exemption or caveats of any kind, because I have developed a completely integrated and internally consistent explanation, made possible only because I began by identifying the actual origin of the economic process. From that point on, a process of enlightenment unfolds, being hinged simply on an observation with respect to how the principles of energy in various states of feedback have manifested through the agency of various representative forms, such as food, tools and money. The result is a seamless overview that is particularly applicable towards a complete understanding of the phenomenon of economic decline.

Do you remember any of your high school science classes? You were clearly told that every thing and every event could be described in terms of energy. Everything! This, of course, is what E= MC2 means. And yet, as you grew into adulthood, you quickly adopted the prevailing notion that the ‘value’ of money was really just an ‘abstract concept’ and therefore something best left in the hands of people who really understood money ... bankers. Don’t even bother wondering how they managed to take over the world. And don’t scratch your head over why the monetary systems are now collapsing. Nature hates a vacuum; so it hates the financial sector most of all.

So in order to avoid the implosion of our own skulls, let’s all take a fresh look at reality. In seventh grade, you were also told that every form of energy could be converted into every other form. Therefore, take a moment to consider all of the various forms of energy that comprise the phenomenon of economics today: Food (energy source); human and animal labor (energy sources); the entire spectrum of technologies, all based on --take a note!-- the physics of fundamental forces, forces that serve to provide either a direct source of energy, or as a means to effectively amplify the effective energy of every consumer organism (can-openers; telephones; cars, etc.); and fuels (food for technology) of a chemical or atomic nature.

Think now. Many times a thing is more obviously recognized by its absence than its presence. Therefore, if we conceptually remove all of the above categories from the economic process, what remains? Money –which all of our banker friends would have you believe comprises the very essence of the economic process.

But what does money represent? It represents “value,” but this really just begs the question. We have to go just a tad deeper. For example, one can buy food with given quantity of money, because money is supposed to accurately reflect the relative ”value” of food? And what comprises the essence of this ”value.” In the most fundamental sense, the value of food essentially lies in some given quantity of energy. In this case, as in all others, we can clearly see that, at the most basic levels, the term “value” is really just an unrecognized synonym for “energy.” In other words, if one removes all of the energy from food (fuels) –or tools, then one also automatically removes their very purpose and meaning as well.

Everything about economics can therefore be transcribed in terms of energy and understood in terms of pure physics. After all, while physics can most assuredly be described in the symbolic terms of numbers, this obviously does not mean that the dynamics of physical systems are based on abstract concepts.

In other words, money is far from fundamental to the phenomenon of economics and can, in fact, be completely replaced in terms of energy.

Gold is an implicit energy standard

And this finally brings me to a final and brief discussion of the gold standard. At this moment in time, I am, myself admittedly a gold bug. But this is merely as a practical matter, because I know that the true attraction of gold as money stems from its virtue as an implicit energy standard.

You see, while the ”value” of gold is often alleged to reside in its relative rarity –and therefore uncommon and “precious” by definition— the term “rarity” is really just shorthand for “requiring a great deal of energy to obtain.”

For example, Earth probably has a blob of gold the size of Texas floating at its core. Go ahead, pick a number; but the point is, what would be its “value” as a currency if every particle of gold in the planet were to somehow vibrate its way to the surface one fine day? Under these remarkably horrifying circumstances, it is likely that the entire surface of the globe would become covered with gold to the depth of several inches at the very least.

What would be its “value”? It would not be absolutely zero, because gold does indeed provide significant technological advantages in terms of current flow over many other elements. However, this value would essentially be determined by how much energy it would take to bend over …and pick it up…

As fate and nature would have it though, gold remains the ultimate fallback currency --to this point anyway-- because the cost in energy to obtain it has remained largely consistent over the centuries. There are more industrial methods of extraction since the days of the Roman Empire, but the quantitative demand and the “cost” of energy itself is greater (“cost”: i.e. takes more energy to produce energy).

Gold is therefore necessarily the default currency towards which the world is inevitably gravitating in its spontaneous search for stability. Gold secretly represents a relatively consistent quantity of energy, and thus provides a relatively stable benchmark for the underlying value of everything else.

Parallel reality: a Post Paradox world

Beyond gold and fiat currencies and currencies based on multiple-commodity standards lies a whole new set of potentials. This is a stage at which the underlying reality and the true principles of principles emerge into the light of day. “Economics” is transforms into a field of science, and the implications are such that economic systems can then be literally engineered to produce states of permanent and universal prosperity, and all the paradoxes and economic conundrums and shortages characteristic of the current regime are automatically nullified.