So in spite of every indication that the field of economics is simply unable to explain the nature of economics --especially in terms of currency alone-- the field as a whole nevertheless continues to cling to the bizarre notion that a mere medium of exchange can be so "fundamental" to events that it can be effectively utilized as the very essence of the economic process itself.

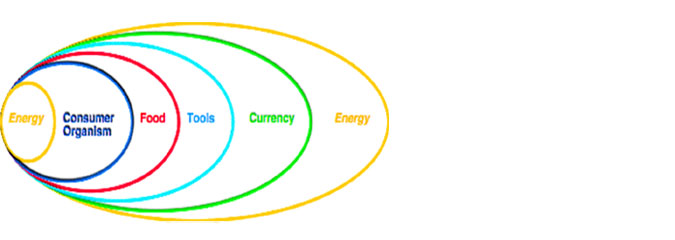

And therein lies a fatal flaw with global consequences that manifest in terms of perennial widespread political and economic instability. For in reality, money is merely a tool for the underlying reality, and as a tool shares the same fundamental meaning common to every tool: as a device to effectively amplify the energy of the economic continuum. How? --by reducing the total quantity of energy that would otherwise have to be expended (consumed) for a given number of trades... In other words, it has a direct bearing on the underlying physics of the "economic" continuum. Unfortunately, this result is already presupposed by the present system, and no further vitality can be injected into a given system simply by manipulating the quantitative flow of the prevailing currency.

The only exception to this rule would be if energy was the currency of the day...; that is, if the money system was fully integrated with energy as the source of all "value."

But this explains why every attempt to prevent or mitigate the ravages of economic decline simply by manipulating the Money System has never proved to be very effective; because if you wish to truly control the system at hand, increasing the flow of energy through the system is the only effective means. After all, this has been natures' way since time began.

Since all this still very problematic to a great many people, I will therefore offer a simple parable to illustrate the distinction between the Money System and the underlying Energy System of physical reality: This is the parable of One Pig Certificates:

Let's say that I have a small herd of pigs. This herd is the essential substance of my personal "economic" system. In order to maintain this economy, I must of course provide a source of energy (food) for these pigs to consume, or else they will neither grow nor even remain alive. In short, each pig is an organic energy system that, in turn, requires an organic energy source.

This is a circular, feedback energy system.

Pigs eat in order to continue eating; just as I continue feeding pigs in order to feed myself. The pigs themselves are an organic source of energy for me; otherwise, I would not have the energy to continue raising and feeding pigs. It's a system: I, the pigs, the food that the pigs eat, and the energy I expend to insure that the pigs are fed, comprise an economic continuum of events. Moreover, the more pigs I have (more potential energy in my possession) the wealthier I am, because the energy they represent is absolutely equivalent to the total "value" with which I make my living.

But now, let's say that I need to paint my house and the front door is hanging off its hinges. I'm too busy maintaining my pig system, so I don't have the time (i.e. energy) to repair these things myself, and therefore must find someone else, but the only thing I have to offer this person in fair exchange for their (labor) --the energy they must expend in order to complete these tasks-- is a pig.

However, for whatever reason, while they are willing to expend the energy, they cannot immediately take possession of the pig itself, so they are willing to accept a title to a pig instead and perhaps come back at a later date to collect it --although they do mention in passing that they might also trade this title to their Uncle Sam on their fathers' side in exchange for a small plot of land-- so! on a piece of paper I write: "Good for One Pig. This Certificate May Be Redeemed by Any Bearer for One Pig." After the worker has completed the job, I then give him this Certificate and off he goes, and we are both pleased with the transaction.

But what if the pig to which he now has title dies? What if I run out of food (the fuel source for my pig economy) and they all die? What would be the "value" of the One Pig Certificate I gave him? Absolutely nothing, of course! Why? Because the "value" of the Certificate I gave him is based entirely on the essence of a purely physical reality. It is in fact a concrete energy system --not a Certificate System that can be manipulated to produce prosperity.

The real principles of the "pig" economy are thus the energy principles of the "value" of food. For example, the idea of deferring payment by means of a written promise on paper is itself surely an abstract concept, and it can be exchanged over and over again by others in a long chain of deferred payments. However, at some point, the economic process itself will spontaneously require a final accounting: --in that the essence of the "value" that backs all these transactions is truly supported by some form of accessible energy (labor, food, fuel, tools, etc).

Otherwise, I would be able to merely feed my pigs One Pig Certificates instead of their favorite energy sources, and all would be well. But naturally, only a government would think that it could do that with impunity...

For instance, what if the worker who received title for his potential pig also decided to simply print copies of his One Pig Certificate, and then offered these as redeemable One Pig notes in exchange for, say, bushels of corn, stacks of lumber or perhaps, a very, very long vacation out of town? If the pig he was given title to gave birth to a litter, then there might be enough pigs to go around, but if not, all of his One Pig Certificates in total would still only be backed by one pig in reality --and the realizable value of each Certificate would depreciate in direct proportion to the ratio of Certificates to Pigs. In other words, each Certificate would potentially retain its stated value only if the energy system that it stood for also expanded in direct proportion.

The point of all this is to merely underscore a fact that seems to defy the perceptive power of conventional intelligence: that the dominant principles of the economy are not based on the nature of currency or the principles of money management, but are based only on the physical energy resources of the underlying system! In brief, "economics" is not a sociological field at all: it's a field whose principles are ultimately derived from, and dependent upon, the principles of pure physics.

As even as the U.S. economy continues to spiral downward therefore, the quasi-public control center of the money system --otherwise known as the 'Fed'-- is actually oblivious to the most fundamental principles of economics, and has little power to do more than merely normalize the rate of descent.

So naturally, when one is unaware that "value" is just an unrecognized synonym for energy, then ones' interpretation of the system one thinks one perceives is axiomatically disassociated from reality. The Money System thereby becomes nothing more than a highly relativistic, schizophrenic power tool without any firm foundation, and our authorities , who devise macroeconomic policies based on monetary principles alone, cannot even make sense of the dynamics of money. And how bizarre is that?

In the final analysis, the public is much like a hostage victim, trussed up in the back seat of a speeding car, with a four-year old in charge of the steering wheel.

No comments:

Post a Comment